US commercial gaming up 22% YoY in January, with all verticals increasing, led by biggest jump in sports betting

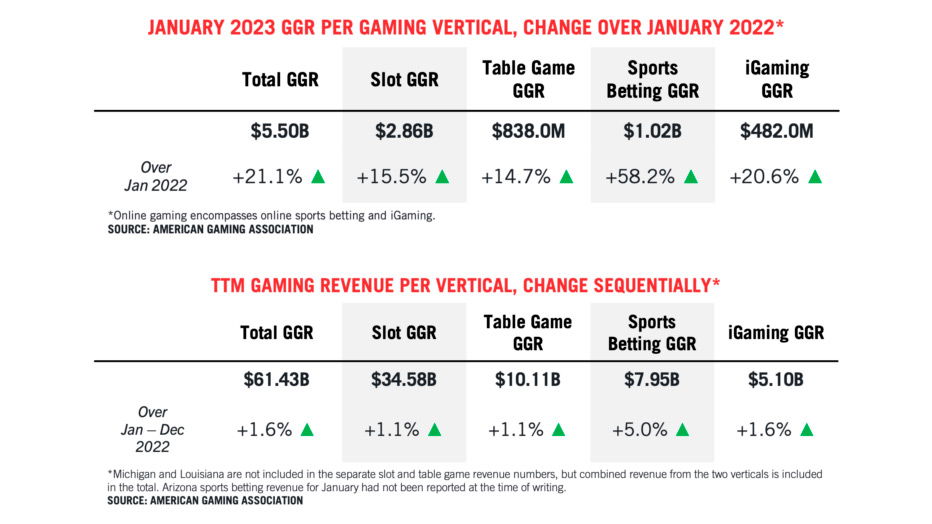

Coming off a record-setting 2022, US commercial gaming has continued its momentum into the new year as the industry set a new single-month revenue record in January. In the first month of 2023, commercial gaming revenue hit $5.5 billion, up 21.1% compared to January 2022. Gaming revenue grew year-over-year across all verticals, led by monthly sports betting revenue exceeding $1 billion for the first time, according to the American Gaming Association.

Traditional casino gaming in January had a solid month with revenue of $3.99 billion, up 14.3% year-over-year. For its part, iGaming generated $482 million, up 20.6% from January 2022 and tying the single-month record from December 2022. These verticals coupled with the aforementioned $1.02 billion in sports betting revenue, up a whopping 58.2%, led US commercial gaming combined to post a new monthly record.

The $5.5 billion in total revenue marks 23 consecutive months of growth for the industry. Although in-person gaming remains the bedrock of the revenue structure, the online gaming segment captured the largest share (26%) of monthly revenue since the peak of the COVID-19 pandemic, notes AGA. At the state level, 31 of 33 commercial gaming states that were operational one year ago posted year-over-year revenue growth in January.

Among the exceptions to the growth experienced in January is Washington D.C., which saw its sports betting market experience a decline of 23.8% compared to the previous year, likely due to increased competition from Maryland in the online betting segment. West Virginia revenue also declined by 6.3%, largely due to one less week of reported operations in January 2023 compared to the same month last year.

Of the $3.99 billion in land-based casino revenue posted for the month, slots took the lion’s share by generating $2.86 billion in revenue, up 15.5% from the previous year. Meanwhile, revenue from table games gained 14.7%, thus reaching $838 million.

AGA notes that the comparison with January 2022 is generally favorable as concerns about Omicron impacted consumer behavior last year and there were two additional commercial casino markets in January 2023: 27 compared to 25. However, the casino calendar was less advantageous in 2023, with only eight weekend days compared to ten in January 2022.

Sports betting revenue, which had an all-time high at $1 billion for the first time, was driven by a busy sports calendar and the launch of legal markets in Ohio on January 1 (retail and online betting) and Massachusetts on January 31 (retail). The total amount of money (handle) Americans wagered on sports for the month reached an all-time high of $10.90 billion.

In January 2023, 29 commercial sports betting jurisdictions offered legal commercial sports betting, compared to 26 last year. Ohio in particular had a great month: the market alone generated gross revenue of $208.9 million in its first month of legal sports betting, setting a single-month sports betting record for any state. But even excluding new markets and online expansions, revenue still increased by 14.9% from January 2022.

As for iGaming, combined January revenue generated by operations in Connecticut, Delaware, Michigan, New Jersey, Pennsylvania and West Virginia increased by 20.6% year-over-year to $482 million, tying the single-month record from December 2022. All six markets reported annual growth for iGaming revenue with half – Connecticut, Michigan, New Jersey – setting single-month state records for the vertical.

https://www.yogonet.com/international/news/2023/03/16/66472-us-commercial-gaming-sets-new-monthly-record-in-january-at-55b-driven-by-sports-betting-jump