Banks steer clear of sports gambling even as more states legalize it

While much of the country was closely watching presidential election results last week, sports gambling quietly became legal in half of all states two years after the Supreme Court broke Nevada’s monopoly on gaming. But some of the biggest banks and credit card issuers are still blocking payment transactions that could supercharge an already booming market for online and mobile wagering. Their main concern? Inadvertently facilitating financial crimes and being punished by federal authorities.

The concerns are all legitimate, according to outside experts.

“It’s a higher risk than even the marijuana-related issues that banks are dealing with,” said Vikas Agarwal, head of the financial crimes unit at PricewaterhouseCoopers.

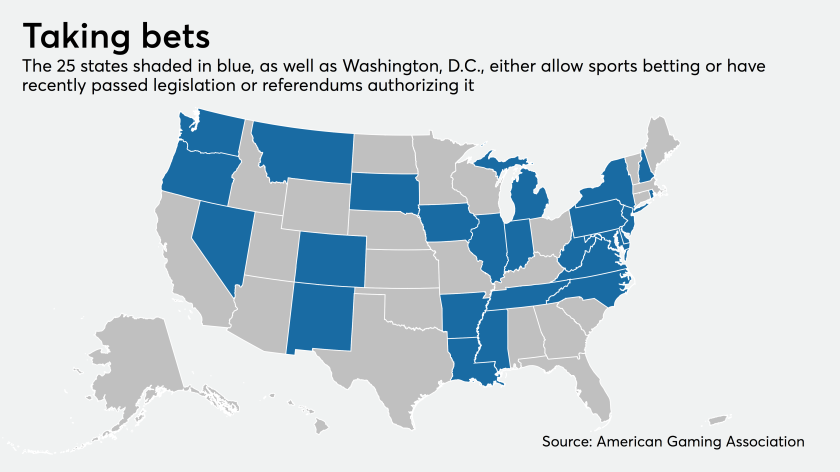

Voters in Maryland, South Dakota and parts of Louisiana approved sports betting referendums on Nov. 3. Twenty-five states and the District of Columbia have allowed these wagers with a handful of other state legislatures set to weigh in as early as this year, according to the American Gaming Association. Five of the states that have legalized sports gambling did so at the ballot box.

For more than three decades, sports betting was contained to Nevada under a federal law passed in 1982. But the Supreme Court ruled in 2018 that the restriction was unconstitutional, freeing up states to consider allowing the business and giving a boost to online apps like FanDuel and DraftKings.

According to FanDuel, banks such as JPMorgan Chase, Bank of America, Capital One, Union Bank and Huntington Bank do not allow their debit and credit cards to be used for online gambling. The worry is that these sites can be used for money laundering and fraud, and banks do not want to run into trouble from federal regulators and prosecutors for unwittingly aiding those illegal activities.

The banks mentioned by FanDuel either declined to comment on their stance or did not respond to inquiries about their policies.

While banks are more open to clearing in-person betting transactions, the hope in the gaming industry is that as more states legalize sports gambling, more financial companies will begin to allow their cards to be used for online wagers. But a major shift by the biggest institutions is not likely until there is a federal law that explicitly permits sports betting.

Jonathan Michaels, vice president of strategic alliances at the AGA, has been meeting with banks to try to smooth over any concerns. Michaels said in an interview that the two sides have made “tremendous progress” since the Supreme Court ruling.

“There’s still a couple of larger banks who are outliers, and we continue to work with partners and folks we know in those banks,” Michaels said. “Some were very quick to say yes, and others are waiting a little longer to see how it is.”

Even with the regulatory concerns, the growth in the industry is enticing.

Global sports betting, whether on a phone or in a casino, is expected to grow 7.1% per year, crossing $100 billion in 2022, Goldman Sachs researchers estimate.

But within that, online sports betting will reach $23 billion, or about one in four sports wagers, once each state in the U.S. weighs in on the issue, according to the advisory firm Roundhill Investments, which based its estimate on data from the boutique research firm Eilers & Krejcik Gaming.

The coronavirus pandemic is expected to boost the trend as more consumers — and gamblers — are staying home and entertainment is being confined to their screens. The AGA estimates that 57% of last year’s casino visitors are making wagers online.

“That’s certainly accelerated in light of the pandemic,” Michaels said.

The trade group released a report earlier this year on a regulatory framework for freeing up more digital payments for making wagers, including proposals to unify anti-money-laundering rules for banks and casinos that could facilitate more debit and credit card transactions.

The Financial Crimes Enforcement Network has not spoken out or issued new guidance on sports betting since a speech last year from Director Kenneth Blanco. He said at the time that it was important for casinos to integrate sports betting operations into their anti-money-laundering programs and suspicious-activity monitoring.

“This includes offering sports betting through a mobile app,” Blanco said.

Agarwal at PwC points out that while the bigger banks are sitting on their hands about the growing business, smaller ones are partnering with financial technology companies to figure out how to move money safely.

“Those banks are almost making a business of going after higher-risk customers,” Agarwal said.

That said, bigger banks are adopting the kind of technology that will help them grab big chunks of this market once they receive a regulatory green light, he said.

“We’re getting to that inflection point as these smaller banks are growing rapidly. They’re getting into range where they’re getting more competitive,” Agarwal said. “You’ll see movement in the next 12 to 18 months in this space.”

https://www.americanbanker.com/news/banks-steer-clear-of-sports-gambling-even-as-more-states-legalize-it